clay county tax collector mo

Missouri law states that you must claim your personal property in the county you resided in on January 1st. The format for Real Estate is 14 numeric digits.

Clay County Missouri Tax A Resource Provided By The Collector And Assessor Of Clay County Missouri

816 407 - 3370 email.

. Starting November 1st Property Tax payments can be made without an appointment at our Green Cove and Keystone branches or by making an appointment at our Bear Run and Park Avenue. GISMapping Assessors Office phone. Clay Countys Administration Building has.

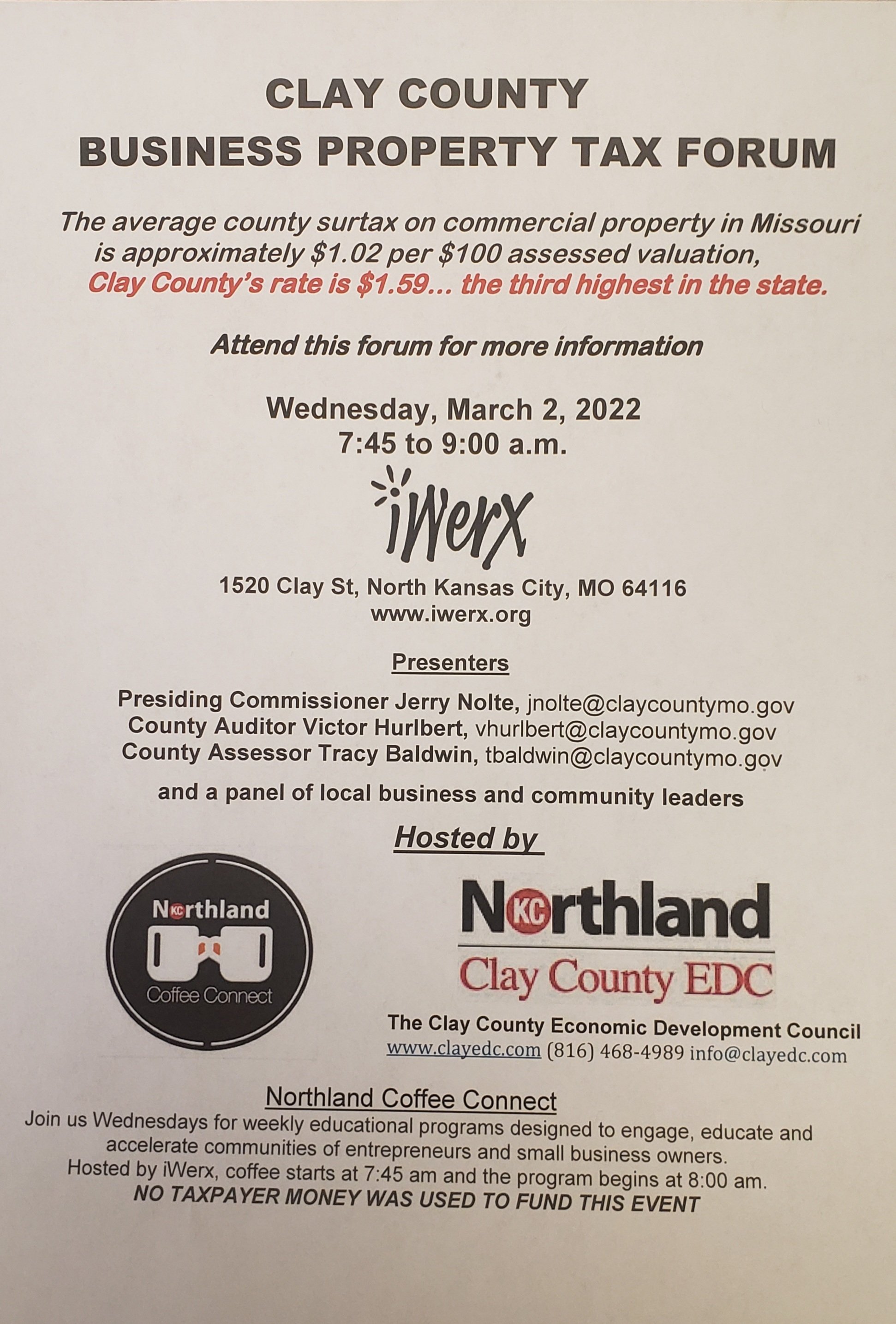

Ad valorem taxes are levied annually based on the value of real property and tangible. Clay County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Clay County Missouri. County tax bills including the City portion also are now available online through.

Clay County Alabama Revenue Commissioner pageDescription. Clay County is fully committed to implementing every one of the Auditors recomendations. Clay County Tax Codes are composed of pairs of digits separating by dashes and each pair of digits represents a taxing district such as school city fire road hospital water.

Businesses registered with the Missouri Secretary of State as an active business do not have to appoint a Clay County Missouri agent. The format for Personal Property is 14 numeric digits the first three digits are zeros. The Tax Collector collects all ad valorem taxes and non ad valorem assessments levied in Clay County.

Property owners are required to pay property taxes on an annual basis to the County Tax Collector. We would be happy to put you on our mailing list for the next year. Premier customer service for our taxpayers will always be our number one priority.

Commissioners and County leadership have and will continue to make necessary changes in. Issued in the name of the Clay County appointed agent. Missouri Department of Revenue Home Page containing links to motor vehicle and driver licensing services and taxation and collection services for the state of Missouri.

The Treasurer is responsible for receipting all County revenues making bank. Tax bills are mailed out in November of each year and are due December 31. 816 407 - 3370 email.

Is located at the Clay County Annex and is open Monday through Friday 8am-1pm. Business Personal Property - The business dept. If the owner neglects to pay hisher property taxes by the end of May.

Clay County Mississippi Tax Assessor Collector thodgeclaycountymsgov Clay County Tax AssessorCollector Porsha Lee Tax Assessor-Collector I would like to thank you for visiting. Our goal is to provide the citizens and taxpayers of Clay County with efficient cost-effective tax services. You may either call 816-407-3460 or send an.

Property Account PARCEL Number Search. The Clay County Treasurers Office operates in accordance with the statutes of the State of Missouri.

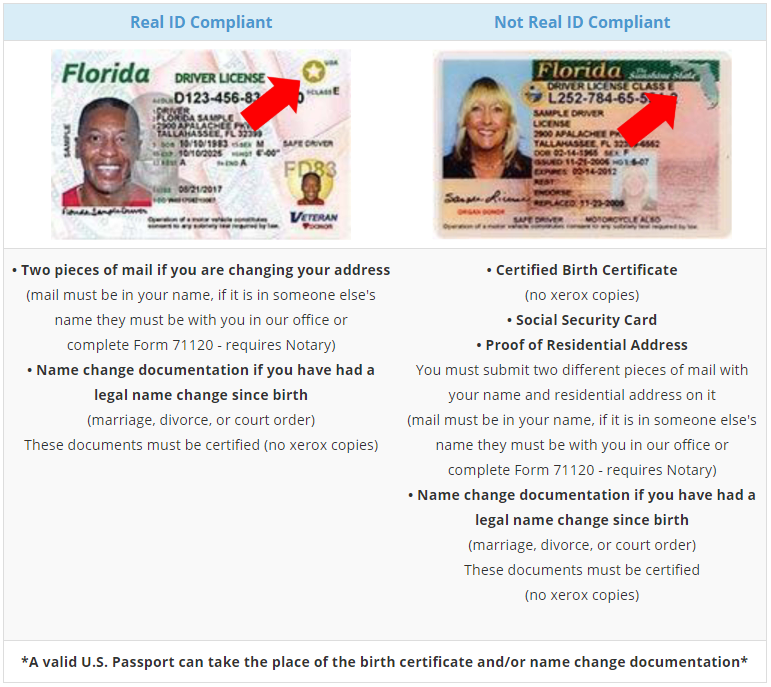

Driver License Or Id Card Appointment Columbia County Tax Collector

Clay County Missouri Clay County Missouri

Lh Mcevoy Collector Mcevoycollector Twitter

Contact Us Clay County Clerk Of Court

Tax Sale Clay County Missouri Tax

City Administrator City Of Centralia Missouri

Payfric Crunchbase Company Profile Funding

Individual Landmarks City Of Excelsior Springs Mo

St Francois County Tax Sale 2022 By Daily Journal Online Issuu

Sou Bookkeeping And Tax Services

Victor S Hurlbert Gopfalcon Twitter

Clay County Collector What To Do If You Were Late On Your Property Taxes The Northland News

Civicsource Com The Property Auction Authority

.jpg)